Hello, readers!

The Indian stock market is buzzing with excitement as we ride through a bull market run that seems unstoppable. In our latest episode of The Big Perspective, I sat down with Ashish Gupta, CIO of Axis AMC, to discuss this powerful rally and what’s driving it. We covered everything from the mega trends shaping the market, like the China+1 strategy, to the sectors he believes hold promise, such as power and defense. We also explored the state of the Indian banking system, the impact of rising IPO flows, and how market sentiment stacks up against reality.

If you’re wondering where to place your bets or how to navigate this wave of market enthusiasm, this episode is packed with insights you won’t want to miss.

The Bull market run and what’s driving it

The current bull market has been on a spectacular run, with the Indian stock market not posting a negative annual return in the past eight years. Ashish Gupta emphasized that while it’s easy to get swept up in the excitement, it’s crucial to guard against complacency. Many new investors have only seen the upward phase of this cycle and may not be prepared for the inevitable corrections. The market’s long-term growth is backed by strong fundamentals, like India’s GDP growth, rising corporate earnings, and robust domestic liquidity from mutual fund SIPs, EPFO, and insurance inflows. However, investors must remember that past performance doesn’t guarantee future returns, and maintaining a realistic outlook is essential.

Mega trends: China+1 and more

Ashish highlighted some key megatrends shaping the market right now. One of the most significant is the China+1 strategy, where global companies are looking to diversify their supply chains beyond China. India is emerging as a strong alternative, particularly in manufacturing sectors like electronics and chemicals. This shift is expected to benefit several Indian industries as they capture a larger share of global manufacturing.

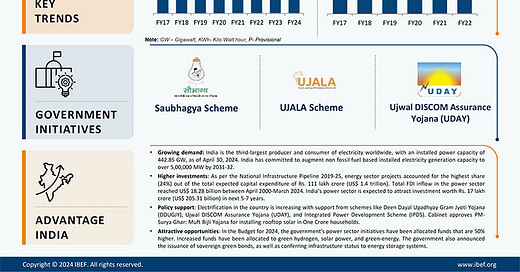

The Make in India initiative is another big theme, driving growth in sectors like defense and power. The Indian government’s push towards self-reliance is resulting in increased investments in these areas. Companies involved in defense manufacturing and power infrastructure are seeing strong demand as India ramps up its domestic capabilities. Gupta believes that these sectors are set to benefit from structural tailwinds over the next few years.

Promising sectors: Power and Defense

Ashish Gupta expressed optimism about sectors like power and defense, which are seeing significant interest from both retail and institutional investors. In the power sector, the rising demand has outpaced supply, leading to a cyclical upswing. With the focus on renewable energy and improving power infrastructure, companies in this space are well-positioned for long-term growth.

In the defense sector, the emphasis on indigenization under the Make in India initiative is creating ample opportunities for local companies. With increasing defense budgets and a focus on reducing imports, domestic defense manufacturers are poised for a strong growth trajectory. However, Ashish also cautioned that while these sectors hold promise, investors should be selective and consider valuations before jumping in.

Indian banking system: stability and caution for NBFCs

Ashish provided an insightful look into the current state of the Indian banking system, noting its strong health compared to previous years. Banks have significantly cleaned up their balance sheets, with net NPAs now at historically low levels. He highlighted that regulatory measures have also tightened, reducing the risks that plagued the system during crises like the IL&FS debacle.

However, the road ahead for NBFCs is a bit more nuanced. While most NBFCs have strengthened their balance sheets and improved capital adequacy ratios, growth rates have moderated. Ashish explained that the growth in this sector is now more democratized, with most players growing at a steady pace of 15-20%. While this is healthy, it’s a shift from the rapid expansion seen in previous years, reflecting a more cautious approach by lenders.

IPO wave and stake sales: A double-edged sword

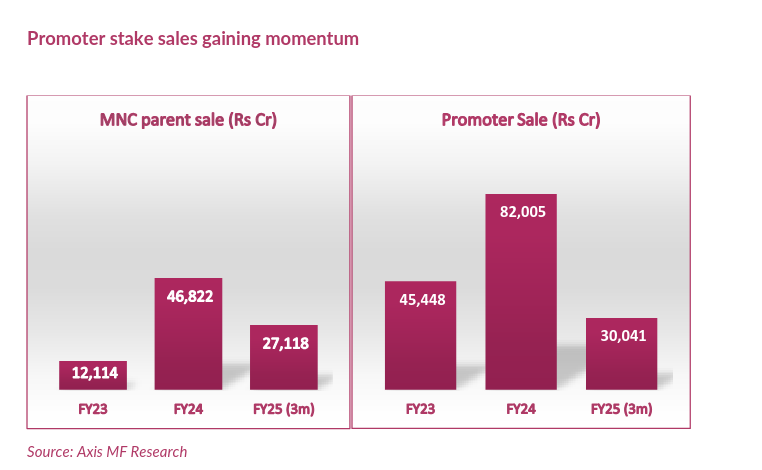

The surge in IPOs and the wave of promoter stake sales have been noticeable trends in the market recently. Ashish pointed out that this influx of new paper is often seen at market peaks, where high valuations encourage promoters and private equity players to cash in. Over the past 15 months, promoters have sold large quantities of stock, and the IPO pipeline remains robust. This increase in supply could act as a cap on valuations, even as domestic and foreign inflows continue to support the market.

He cautioned investors to be mindful of this dynamic. While strong inflows from mutual funds and insurance companies might seem to guarantee upward momentum, the increased supply from IPOs and stake sales could limit further multiple expansion. Essentially, the market is balancing on a tightrope between growing demand and rising supply, and investors should stay alert to shifts in sentiment.

Market sentiment vs. reality

Ashish Gupta discussed the often tricky relationship between market sentiment and underlying fundamentals. While market enthusiasm can drive valuations higher, reality eventually catches up. He emphasized the importance of focusing on earnings growth as a reality check against speculative mania. Sectors like IT have recently seen stock prices rally despite earnings downgrades, highlighting the disconnect that can sometimes occur between sentiment and fundamentals.

According to Ashish, this is a critical period for investors to scrutinize earnings and not get swayed by market hype. With global economic uncertainties and domestic macro trends evolving, it’s essential to remain grounded in the actual performance of companies rather than following market euphoria blindly.

Our final thought

The conversation with Ashish Gupta was a timely reminder of the importance of staying grounded amid the excitement of a bull market. While trends like China+1, growth in power and defense, and the robust health of the banking system paint a positive picture, investors should remain cautious. The wave of IPOs and stake sales suggests a potential cap on valuations, and the gap between market sentiment and reality could lead to surprises.

Ultimately, a balanced approach, focusing on diversified investments and a long-term perspective, is key to navigating this dynamic market environment. If you want to hear more from Ashish Gupta and dive deeper into his insights, check out the full interview here [insert link]. It’s packed with valuable lessons for anyone looking to understand today’s market trends.

Until next time, stay informed, stay diversified, and keep your eyes on the fundamentals!

hello

hello