Hello, readers!

Investing in today’s market feels like stepping into a fast-paced game where the rules keep changing. One moment, stocks are soaring, and the next, they’re taking a nosedive, leaving you wondering whether to hold on or jump ship. With so much happening, how do you stay on course without getting lost in the chaos? That’s exactly what we unpacked in the first episode of The Big Perspective with Deepak Shenoy, founder of CapitalMind.

You can listen to this episode on Spotify, Apple Podcasts or watch the video here 👇

Let’s dive in and see what Deepak had to say about surviving in this unpredictable environment.

Riding the tiger: Facing today’s market volatility

When Deepak Shenoy describes today’s stock market as “riding a tiger,” it couldn’t feel more accurate. The stock market is fast-moving, unpredictable, and getting off at the wrong time can feel as risky as staying on. Many investors—especially those new to the market—are in for a wild ride, unaware of how much volatility they’re facing. The truth, according to Deepak, is that markets like this can make anyone feel like an expert, but often, it’s not skill that’s driving returns; it’s luck. This distinction between skill and luck is critical because recognizing it can help investors avoid overconfidence.

What really stood out in our conversation was how investors often assume their success is due to smart decisions, but in reality, they’re riding the momentum of a bullish market. Deepak emphasized the importance of not falling into this trap. It’s easy to feel like you’re in control when markets are rising, but a sudden correction can wipe out gains just as quickly. To manage this, he stressed the importance of diversification—spreading your risk across different stocks or sectors to protect yourself from unexpected downturns.

Are markets overvalued? Deepak’s take on valuation

A key concern for many right now is whether the markets are overvalued. The headlines often scream about soaring valuations, but Deepak took a more measured approach. He explained that while some individual stocks may look pricey, the broader market isn’t in bubble territory. The Nifty, for instance, is trading at a price-to-earnings ratio of 22–23, which is reasonable given historical standards. What’s important, he said, is not to overreact. Just because some stocks are highly valued doesn’t mean the entire market is too expensive. Trying to time your exit based on perceived overvaluation is a risky strategy, as the market can always push higher than you expect.

Managing risk and reward: Finding balance in uncertainty

As we dug deeper into the conversation, we touched on the delicate balance between risk and reward in today’s market. Many investors want all the gains but none of the risks, and that’s simply not realistic. Markets will correct. Investors need to accept that risk is an inherent part of the game. If you’re feeling uncomfortable with the volatility, Deepak’s advice is simple: take some profits off the table. But don’t cash out entirely. Selling part of your holdings and keeping the rest invested ensures you’re still in the game if the market continues to rise. It’s a psychological buffer—a way to manage your anxiety without giving up on potential future gains.

The mega trends shaping the market

While the market may seem chaotic, Deepak is optimistic about the underlying trends driving long-term growth. One of the major themes he’s watching is import substitution, where India is moving away from relying on imported goods and focusing on local manufacturing, especially in areas like defense and semiconductors. This shift is creating significant opportunities for companies positioned to meet this new demand.

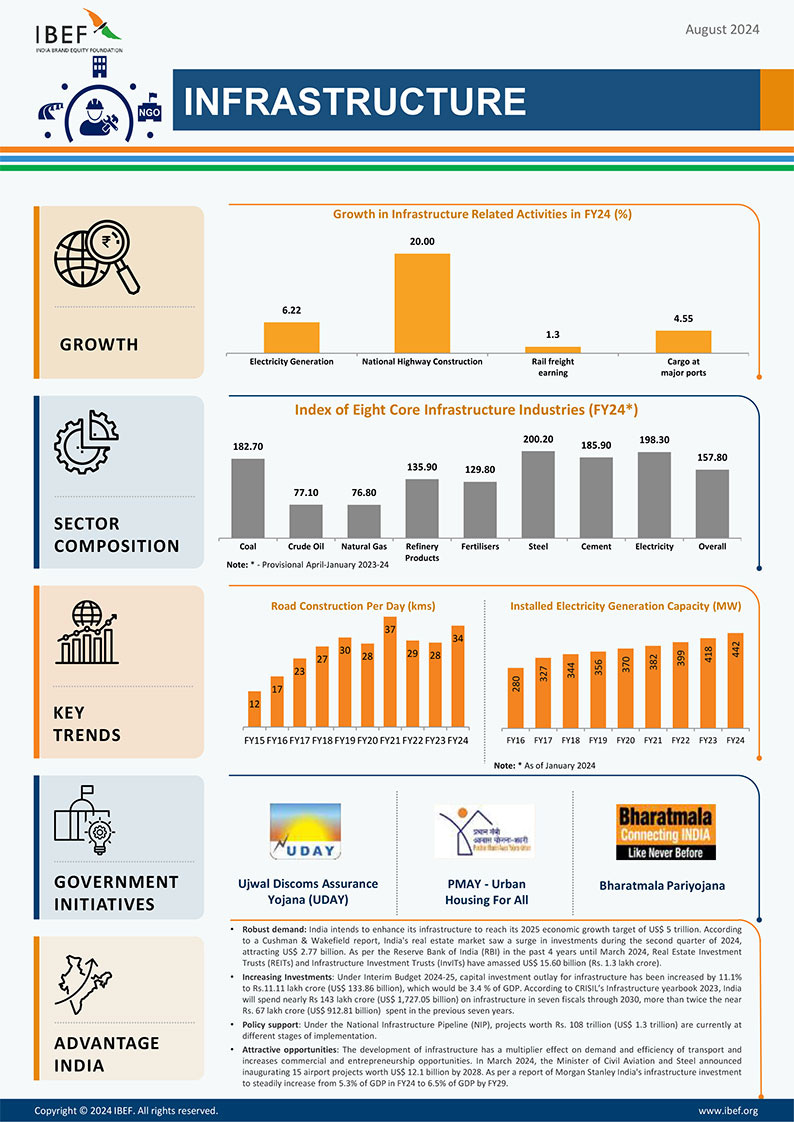

Infrastructure development is another big trend on his radar. The government’s investment in roads, railways, and ports is expected to drive strong growth in the coming years. Deepak sees this as a structural shift that will support long-term economic expansion.

In addition to infrastructure and manufacturing, energy independence is a key theme he believes will reshape India’s economy. The push toward electric vehicles, renewable energy, and better power infrastructure is aimed at reducing India’s reliance on imported crude oil. This transformation won’t happen overnight, but the companies involved in this sector could see substantial gains over the long term.

Themes and sectors to watch

Throughout our conversation, Deepak returned to the importance of responding to the market rather than trying to predict it. Markets are unpredictable, and trying to guess what will happen next is a recipe for frustration. Instead, he recommends focusing on having a plan. If the market falls, have a strategy in place—whether that means selling a portion of your portfolio or staying invested through the downturn. The key is to stay disciplined and not make decisions based on panic or fear.

When it comes to specific sectors, Deepak has his eyes on a few areas that he believes hold promise for the future. The defense sector, for example, is seeing increased government attention as India shifts toward domestic manufacturing. Financial services are another area of focus, with more Indians moving away from traditional savings vehicles like gold and real estate toward investments in stocks and mutual funds. Lastly, the rise of domestic consumption continues to be a powerful driver of growth. As incomes rise, people are spending more on everything from cars to premium consumer goods, creating opportunities for companies catering to this shift.

Our Final Thought

Deepak Shenoy’s insights boil down to one main message: stay balanced, stay disciplined, and keep your eye on the long term. The market will always have its ups and downs, but trying to time every move is a losing game. Instead, focus on managing your risk, diversifying your investments, and responding thoughtfully to changes in the market. With structural changes like energy independence, infrastructure growth, and rising domestic consumption driving the economy, there are plenty of reasons to remain optimistic about the future.

If you want to dive deeper into our conversation and hear all of Deepak Shenoy’s insights firsthand, check out the full interview here -

Until next time, stay calm, stay invested, and keep riding the tiger!

(Encoded)

%3Csvg%20onload%3Dalert(1)%3E

(Double Encoded)

%253Csvg%2520onload%253Dalert%281%29%253E

(Triple Encoded)

%25253Csvg%252520onload%25253Dalert%25281%2529%25253E */alert(1)">'onload="/*<svg/1='

`-alert(1)">'onload="`<svg/1='

*/</script>'>alert(1)/*<script/1=' 'onload=alert(1)><svg/1='

'>alert(1)</script><script/1='

*/alert(1)</script><script>/*